You can build your wealth over time by investing €100 every month. You can choose from ten different investment methods, each with a brief explanation.

- Exchange-traded funds, or ETFs, are investment funds that trade on exchanges. They enable diversification by investing in a basket of assets such as stocks, commodities, bonds or other financial instruments. ETFs give you exposure to different markets and industries.

- Index Funds Index funds are a type of mutual fund that replicates the performance of a specific market index such as the S&P 500. They are a good way to gain broader exposure to the market and usually have lower expenses than actively managed mutual funds.

- Stocks with dividends - Stocks with dividends are stocks of companies that distribute part of their profits in dividends. Investing in dividend-paying stocks can provide stable income and the potential for capital appreciation.

- Bonds: Fixed income securities issued by corporations, governments or municipalities. You lend money to the issuer by investing in bonds in exchange for periodic interest payments and return of principal at maturity.

- Real Estate Investment Trusts, REITs, are companies that own, manage or finance real estate that generates income. By investing in REITs, you can gain exposure to the real estate market without direct ownership.

- Peer-to-peer lending platforms: These platforms allow borrowers to connect with lenders without the need for traditional financial institutions. These platforms allow you to earn interest on the money you borrow, which is more than traditional savings.

- Mutual funds - Mutual funds pool the money of several investors and invest it in a portfolio of stocks or bonds. They are professionally managed by fund managers who make investment decisions on behalf of investors.

- Robo-advisors: These are online platforms for automated investment advice. They use algorithms. They will create and maintain a diversified investment portfolio based on your risk tolerance and financial goals.

- Individual stocks – Investing in stocks of individual companies involves buying shares. Picking stocks with growth potential and undervalued stocks that can provide significant returns requires extensive research and analysis.

- Cryptocurrencies – Cryptocurrencies such as Bitcoin and Ethereum are digital assets that use cryptography to ensure their security. You can buy them and hold them as an investment. They offer the potential for substantial returns, but also a higher level of volatility and risk than traditional investments.

While these investments can generate potential returns, there are also risks. You should do extensive research, determine your risk tolerance and consult with a financial advisor if necessary before making any investment decisions.

What are the best mutual funds and where can they be invested?

Here are some ETFs that are widely known among investors:

Connect with our best brokers

Register your account through TopBrokeri.com and the Top account manager will help you get started with your account!

- Vanguard Total Stock Market ETF VTI : This ETF aims to track the performance of the CRSP US Total Market Index and provides broad exposure to the US stock market.

- iShares Core S&P 500 (IVV) ETF: This fund aims to mimic the performance and return of the S&P 500 index. The index represents the 500 largest public companies in America.

- Invesco QQQ Trust QQQ : This ETF tracks the performance of the Nasdaq-100 index, which consists of 100 non-financial giants listed on the Nasdaq.

- iShares MSCI Emerging Markets Fund (EEM), which offers investors exposure to a range of emerging market stocks and gives them access to the growth potential of developing economies.

- iShares US This ETF seeks to replicate the performance of the Bloomberg Barclays US Aggregate Bond Index, a collection of investment grade US bonds.

- iShares Gold Trust IAU: This fund tracks the performance of gold bullion, allowing investors exposure to precious metals.

- Vanguard FTSE Developed Markets Index ETF (VEA). This ETF tracks the FTSE Developed All Cap ex US Index. Provides exposure to international developed capital markets outside the United States.

- SPDR S&P Divide ETF SDY: This fund focuses on high-yielding dividend stocks with a history of consistently increasing their dividends.

- iShares Global Clean Energy ETF: This ETF is a global ETF that invests in companies in the clean technology and renewable energy sectors.

- VanEck Vectors Semiconductor Fund (SMH). It provides exposure to companies that manufacture semiconductors, an important component of many different technological devices.

You can invest in ETFs through most online brokerage platforms. TD Ameritrade Charles Schwab Fidelity E*TRADE Interactive Brokers and others are popular platforms. Comparing the features, services and fees offered by different brokers is important in order to choose the one that best suits your needs.

Be sure to do your research, read the ETF prospectus and consider factors such as historical performance, expense ratio and fund objective before investing in any ETF.

What are the top index funds that Europeans should invest in? And where you can invest them

There are many index funds for European investors, which provide exposure to a wide range of markets and asset classes. Here are some popular index funds for European investors.

- iShares MSCI World UCITS (IWDA), a fund that tracks the MSCI World Index (representing large and mid-cap companies from developed countries around the world), is available for investment on various European stock exchanges. The fund can be bought on various European stock exchanges.

- Lyxor STOXX Europe 600 Index (DR) UCITS ETF: This ETF attempts to replicate the performance of the STOXX Europe 600 Index. The index includes companies from 17 European countries. It is listed on several European stock exchanges.

- Xtrackers Euro Stoxx 50 (XD5E). This ETF tracks the performance of the Euro Stoxx 50 index, which consists of 50 blue-chip companies from the eurozone countries. It is traded on the main European stock exchanges.

- Amundi Index MSCI Emerging Markets (CEEMEA), UCITS: This ETF is designed to replicate the MSCI Emerging Markets Index. It provides exposure to a wide range of equity securities from developing countries. This ETF can be bought on various European stock exchanges.

- Vanguard FTSE Developed Europe UCITS (VEUR), a fund that tracks the performance of the FTSE Developed Europe All Cap Index. This index includes large, medium and small companies in developed European countries. The fund can be traded on European stock exchanges.

- iShares Euro Corporate Bond UCITS ETF – This ETF focuses on investment grade corporate bonds denominated in Euros and provides exposure to European corporate bond markets. It is listed on several European stock exchanges.

- Xtrackers II Global Government Bond ETF (XGSG) – This fund offers exposure to global government bonds. It tracks the Bloomberg Barclays Global Aggregate Treasury EUR Hedged Index. It can be bought and sold on several European exchanges.

Choose from many European brokerage platforms or online investment companies to invest in these funds. These are some of the most popular options:

- DEGIRO

- Interactive brokers

- XTB

- eToro

- Saxo Bank

- Revolut (for mobile investments)

These platforms provide access to many investment products such as index funds. They also give you the opportunity to invest in a range of European and international markets. Compare the available markets, services and fees on each platform to find one that fits your goals and preferences.

Be sure to do your research before investing in index funds. Review the prospectus and look at factors such as expense ratios and liquidity.

What are some of the best dividend stocks to invest in?

Investing in dividend stocks regularly is a way to get regular income and you can also benefit from potential long-term capital growth. It is important to do thorough research and consider your financial goals and risk tolerance. Here are some European dividend stocks you might want to consider.

- Royal Dutch Shell (RDSA/RDSB), a large integrated energy company with a rich history of dividend payments, business and operations worldwide.

- Unilever (ULVR/UNA), a multinational consumer goods company, offers a range of household products and has a track record of consistent dividend payments.

- Novartis (NOVN), a Swiss multinational pharmaceutical company, is known for the research, development and production of innovative health products.

- Nestle: Nestle is one of the largest food and beverage companies in the world. It offers a range of products and has a long history of dividends.

- Enel is an Italian multinational energy corporation that focuses on renewable energy sources, traditional electricity generation and electricity distribution.

- Banco Santander is a Spanish bank with a large presence in Europe, Latin America and the Middle East. They are known for their dividend payments.

- TotalEnergies: French multinational company involved in the production, exploration, refining and marketing of oil and gas.

- Zurich Insurance Group, headquartered in Switzerland, provides insurance and financial services worldwide.

- British American Tobacco is a multinational tobacco company that offers a variety of cigarettes and other tobacco products.

- Telefonica TEF: Spanish multinational telecommunications corporation operating in Europe and Latin America. Known for its dividends.

You should be aware that dividend stocks may be affected by market risks or changes in the company's finances. It is important to consider factors such as dividend yield, payout ratio, dividend growth history and overall company strength when making investment decisions.

Consider consulting with a financial advisor or doing thorough research on your own to align your investment goals with your risk tolerance and financial goals.

Which bonds can Europeans invest in?

Europeans can invest in various bonds. These include government bonds, corporate bonds and international bonds. Here are some types of bonds and where Europeans can buy them.

- Government bonds: These are bonds that national governments issue to finance their own consumption needs. European investors can buy government bonds issued by their home country or another European country. Government bonds are usually available through auctions in the primary market and trading in the secondary market on stock exchanges. Also, investors can buy government bonds from banks, brokers and online platforms.

- Corporate bonds are issued by companies to raise funds for various purposes. European investors can buy corporate bonds from European companies. Corporate bonds are traded on both the primary and secondary markets. Bonds can be purchased through banks, online investment platforms and brokers.

- European Central Bank (ECB bonds): ECB issues bonds as part of monetary policy operations. Financial institutions can purchase these bonds through specialized channels such as primary dealers. Retail investors have indirect access to ECB bonds through ETFs or bond mutual funds that invest in them.

- Eurobonds Eurobonds, also known as Eurobonds, are bonds issued by a government in another currency. These bonds, which are denominated in euros, can be purchased by European investors. Eurobonds are typically traded on international bond exchanges and can be purchased by banks, brokers or online investment platforms with access to global markets.

- European Investment Bank (EIB), bonds: EIB bonds are issued to finance projects that support the economic growth of EU member states. EIB bonds can be purchased by European investors through auctions on the primary market and trading on the secondary market. EIB bonds can be purchased through online investment platforms, banks, brokers and brokerage firms that have access to bond markets.

When buying bonds, Europeans have a variety of options to choose from.

- Banks offer bond trading services to their clients, which allows them to buy bonds directly at the bank's cash desk.

- Brokers: Online brokerage platforms provide investors with access to secondary bond trading. They enable them to buy and exchange bonds.

- Online investment platforms. There are online platforms that allow investors to access the bond markets. This allows them to buy bonds from various issuers.

- Primary market auctions Some government bonds are sold through primary market auctions, where investors have direct access to purchase newly issued bonds.

Before investing in bonds, it is important to consider factors such as credit rating, bond yield, maturity and financial status of the issuer. For informed investments, it is also advisable to speak with a financial planner or do extensive research.

Where can you buy the best REITs in Europe?

Real estate investment trusts, or REITs, can give you exposure to the real estate sector and generate income through dividends. Here are some of the best European REITs and potential locations to buy them.

- Unibail-Rodamco-Westfield (URW): a leading European commercial real estate company specializing in shopping centers and office buildings. The company is listed on major European stock exchanges such as Euronext Paris (Paris), Euronext Amsterdam (Amsterdam) and Xetra.

- Vonovia SE: A German residential real estate company that owns, operates and manages a large portfolio in Germany. The company's shares are listed on the Frankfurt Stock Exchange.

- SEGRO plc, a UK REIT with a focus on industrial and logistics property. It is listed on the London Stock Exchange.

- Land Securities Group plc (UK): This REIT focuses on commercial real estate in the UK, such as offices and retail space. It is listed on the London Stock Exchange.

- Deutsche Wohnen SE: German residential real estate company with a large portfolio of rental properties in major German cities. Its shares are traded on the Frankfurt Stock Exchange.

- British Land Company plc : British REIT with a diversified portfolio including retail, mixed-use and office properties. It is listed on the London Stock Exchange.

- Gecina SA, a French REIT focusing on office and residential real estate. Euronext Paris is a list.

- Klepierre, a European REIT with a focus on shopping centers in various European countries. Euronext Paris is a list.

If you want to buy these REITs, consider the following options

- Online Brokerage: In Europe, many online brokerage platforms offer access to major stock exchanges. This allows you to buy and sell REIT shares. Platforms such as the DEGIRO Interactive Brokers XTB and XTB can be used.

- Traditional Brokerage Firms: Traditional brokerage firms with physical branches provide services for buying and selling REIT shares. Some famous examples include banks such as Barclays, Deutsche Bank and Societe Generale.

- Direct Investment Plan: Some REITs offer direct investment plans and dividend reinvestment plans (DRIPs) that allow investors to buy shares directly from the company. You can check if REITs offer these plans on their official websites.

Research and evaluate REITs before investing. This includes evaluating the REIT's property portfolio, its financial performance and dividend history. Consider consulting with a financial advisor or conducting thorough research to align your investment goals with your risk tolerance and financial goals.

What are some of the best peer-to-peer lending platforms?

P2P lending platforms offer investors the ability to earn interest and borrow money. These are the best P2P lending platforms to consider.

- LendingClub – LendingClub has become one of the largest, most recognized peer-to-peer lending platforms in the United States. It offers personal loans, business loans and patient financing. LendingClub, as far as I know, does not accept foreign investors.

- Prosper: This is a P2P lending platform that specializes in personal loans. Prosper, similar to LendingClub and open only to US investors, is a P2P lending platform.

- Funding Circle – Funding Circle, a global peer-to-peer lending platform, operates in several countries. This includes the United Kingdom and Germany. Its main focus is on lending to small businesses.

- Mintos – Mintos is a European P2P marketplace that connects lenders with investors in various countries. It offers a variety of loans such as personal loans, mortgages and business loans.

- Bondora – Bondora is a P2P lending platform in Estonia that offers personal loans to borrowers, primarily from Estonia, Finland and Spain. It allows investors to build portfolios from loans in different countries.

- Zopa – Zopa, one of the oldest peer-to-peer lending platforms in the UK. It is a personal loan provider with a proven track record.

- RateSetter – RateSetter is a well-established P2P lending platform in the UK. It provides personal loans, property development loans and business loans.

- Twino: Twino in Latvia is a P2P lending platform focused on consumer loans. It is active in several European countries, and investors can diversify by investing with different loan originators.

P2P lending comes with risks. This includes debtor default risk and platform risks. Before investing, carefully review the platform's loan diversification and performance history, as well as the platform's terms and conditions. Consider factors such as transparency, investor protection and platform reputation.

Do your research on P2P lending and consult with a professional advisor if necessary.

What are some of the best European mutual funds?

These are the most popular investment funds for European investors.

- BlackRock European Equity Index Fund – This fund aims to replicate the FTSE Developed Europe ex UK index and provides exposure to both large and mid-cap European companies.

- Fidelity Global Technology Fund (Fidelity Global Technology Fund): This fund is focused on investing in technology companies around the world, providing exposure to global technology.

- Vanguard LifeStrategy Funds Vanguard offers a variety of LifeStrategy funds, each with different allocations between equity and fixed income investments. This allows the investor to choose the desired level of diversification and risk.

- Pictet Global Megatrend Selection Fund (Global Megatrend Selection Fund): This fund invests in companies that will benefit over the long term from global trends, including technological innovation, demographic change and sustainability.

- M&G Global Dividend Fund: This fund is designed to provide long-term growth and income by investing in global dividend-paying stocks.

- Threadneedle European select fund: This is a fund that focuses on European stocks, with the aim of investing in companies that have the potential for sustainable growth. It also aims to buy at attractive valuations.

- JPMorgan Global Income Fund (JPM): This fund seeks to generate stable income by investing in a diversified portfolio of global equities and fixed income securities.

- Fidelity Emerging Markets Fund (FEMF): This fund invests in companies located in emerging market countries, exposing their growth potential.

Europeans can choose from a variety of options when investing in mutual funds.

- Directly through the funding provider. Many fund providers such as BlackRock, Fidelity Vanguard Pictet M&G and Vanguard offer their mutual funds directly to investors. Investors can access these mutual funds through the fund provider's website or by contacting them.

- Online investment platforms. Several online platforms and brokers offer access to a variety of mutual fund options. Examples include platforms such as DEGIRO Interactive Brokers eToro Hargreaves Lansdown.

- Banks and financial institutions: European banks offer investors their own range of mutual funds. Investors can contact their financial advisors or banks to learn more about the options available.

Before investing in a mutual fund, it is important to thoroughly review the fund's prospectus, performance, fees, as well as the records of fund managers. Consider factors such as your investment goals, risk tolerance and time horizon.

To make an informed investment decision based on your personal circumstances, please consult a financial advisor.

What are the best robo advisors? How to start?

You can find a number of reputable robo advisors that offer automated investment management. Some of the most famous robo-advisors are:

- Betterment – Betterment is an automated investment advisor that creates portfolios for you based on your risk tolerance and goals. Provides low-cost, diversified ETF portfolios. Additional features include tools for tax loss harvesting and financial planning.

- Wealthfront – Wealthfront is a well-established robo-advisor that uses modern portfolio theory to create and maintain diversified portfolios. It includes features like direct indexing, tax efficient investing and money management accounts.

- Nutmeg – Nutmeg is the UK leader in robo-advisors. It offers diversified investment portfolios with different levels of risk, as well as options for pensions, stocks, shares and ISAs.

- Charles Schwab Intelligence Portfolios – Charles Schwab's platform for robo-advisors offers a variety of features and investment options. It features automated portfolio management and tax loss harvesting. Financial advisers are also available.

- Vanguard's Personal Advisory Services - Vanguard is well known for its low-cost index funds and ETFs. It also offers a hybrid roboadvisor. Investors can receive personalized advice and automated portfolio management from human advisors.

In order to start using a robo advisor, you will need to take the following steps.

- Compare: Compare the features, investment strategy, fees and services provided by different robo-advisors. You can find the perfect fit by comparing factors such as account types, minimum investment requirements and customer feedback.

- Sign up and open an account: Once you've chosen a roboadvisor, visit their website to sign up for an online account. You will usually be asked to provide certain personal information such as your name, contact information and financial goals.

- Complete a Risk Assessment: Most robo-advisors require you to complete a risk assessment or questionnaire to determine your risk tolerance level and investment goals. This information will help the robo-advisor make the appropriate recommendation for your portfolio.

- After creating your account, you will need to transfer money to the platform. You can usually transfer funds electronically or by wire transfer from your bank.

- Portfolio creation and management: Based on the risk profile you have and your investment goals, the robo-advisor can create and manage your portfolio. The platform will automatically allocate your money to different asset classes. It will also be periodically rebalanced to maintain the portfolio's target allocation.

- Monitor and Review – Monitor and review your robo advisor account regularly to stay up to date on portfolio performance and any suggested adjustments. Some robo-advisors provide educational and financial planning resources.

Although robo-advisors can automate investment management, their use may not be appropriate for all individuals or situations. Consult a financial advisor if you need tailored advice or have specific investment requirements.

Before investing, review the robo-advisor's terms and fees as well as their investment approach.

What are some of the best performing individual stocks of 2010 and the best platforms to buy them?

Here are some well-known examples of companies that experienced significant growth during this period.

- Amazon (AMZN: ) The e-commerce giant has grown rapidly since 2010, largely thanks to its dominance in the online retail sector, its cloud services (Amazon Web Services), as well as its expansion into other industries.

- Apple (AAPL: Apple ) has had an incredible decade thanks to its iPhone, as well as the expansion of other product lines such as wearables and services.

- Microsoft ( MSFT ), under Satya Nadella as CEO, has seen strong growth fueled by its Azure cloud computing platform (as well as its software and productivity services).

- Alphabet: This parent company has grown significantly, primarily due to its dominance in the search engine market and its expansion into digital sectors.

- Tesla (TSLA). Tesla has been one of the most successful companies in the past decade thanks to its innovation and success with electric vehicles.

Please note that past performance is not indicative of future performance, and investing in individual stocks carries inherent risks. Before making any investment decision, you should do thorough research and understand the company's fundamentals.

You have a variety of options depending on where you are in the world. Here are some popular platforms.

- Interactive Brokers – Interactive Brokers provides access to international stock exchanges at competitive prices.

- TD Ameritrade – TD Ameritrade, a popular investment platform in the United States offers a wide range of options including individual stocks.

- ETRADE – ETRADE offers access to stocks, bonds and other investment instruments.

- DEGIRO – DEGIRO, a pan-European platform for online brokerage services, is known for its low-cost trading services and easy access to international exchanges.

- Hargreaves Lansdown – Hargreaves Lansdown offers a range of investment products in the UK, including individual shares.

- Robinhood has gained popularity due to its user interface, which allows for commission-free trading. Please note that availability may vary by country.

Compare the features, market availability, fees and investor protection offered by different platforms to choose the one that suits your investment goals. Do thorough research, read the terms and conditions of each platform and seek financial advice before making an investment decision.

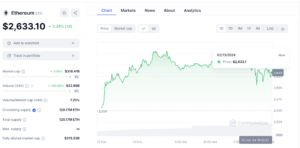

These are the 10 best performing cryptocurrencies for 2023 based on their market capitalization.

- Bitcoin (BTC), market cap $506.7 billion. It is the original cryptocurrency. Its price has soared in recent years, with an increase of 5.124% since May 2016. Bitcoin has a sentiment score of 64 in 2023, indicating a generally positive sentiment.

- Ethereum (ETH) : Market capitalization is $209.5 billion. Developers love this cryptocurrency for its many potential uses, such as smart contracts or NFTs. Its price increased by 15.740% between April 2016 and the end of June 2023.

- Tether: Market cap is $83.5 billion. It is a stablecoin that is backed by fiat currency, and is preferred by investors who are wary of the extreme volatility of other coins.

- Binance Coin: Market cap of $37.7 billion. Binance is one of the world's largest crypto exchanges. Use this cryptocurrency to trade and pay fees. Since launch, its price has increased by 241.902%.

- US Dollar Coin USDC: Market cap of $28.3 billion. This stablecoin is backed in US dollars and aims for a 1:1 exchange rate with the USD.

- XRP: Market cap of $27.6 billion. The Ripple network uses it to facilitate the exchange of currencies, including fiat and other major cryptocurrencies. Its price has increased by 8.744% compared to the beginning of 2017.

- Cardano: Market cap of $9.7 billion. Cardano (ADA) is known for being the first to adopt proof-of-stake verification. It also enables smart contracts and other decentralized applications. The price of the coin increased by 1.295% compared to 2017.

- Dogecoin, DOGE: market cap $8.6 billion. As a joke in 2013, Dogecoin has grown into a popular cryptocurrency.

- TRON: Market capitalization is $6.5 billion. The price of this decentralized block chain has increased by 2700% since October 2017.

- Solana: $6.1 billion market cap. The price of the cryptocurrency increased by 1.886% in just one year since its launch, which was in 2020.